Overview

Additional Pay Batch Process

The Additional Pay batch process may be used to submit 20 or more one-time additional payments. It cannot be used to submit ongoing additional payments or to load payments for records with an empl_status (Employee Status) of L (On Leave), W (Short Work Break), T (Terminated), or R (Retired).

Limits: While there are no formal published limits, there are guidelines. A unit determines the amount based on business need and budget. Additional Pay Resources are available designed to support the use of various types of additional pay.

The Additional Pay batch process is one of the tools in the HR Batch Toolkit, a set of spreadsheets and programs that enable you to upload changes to the M-Pathways system for multiple employees at one time. This document provides explanations of the fields in the spreadsheet template used for the Additional Pay Batch process. See the HR Batch Toolkit in My LINC for an overview of the HR Batch Toolkit, including the process for initiating a batch process.

Additional Pay Batch Spreadsheet Template

The Additional Pay batch load needs to be completed before the pay sheet creation of effective date for payment. The requested batchload must be received at least 3 weeks prior to the effective date of the additional pay. Please contact the SSC Data Management Team for any variance on the timing of this batch load.

To initiate a Additional Pay Batch process, contact the Shared Services Center (SSC) HR Data Management Team. An HR Data Management Associate will contact you confirming your request. The Additional Pay Batch spreadsheet template is available in My LINC. For each employee that should receive an additional pay, fill in the fields with the information described below. Once completed, click the Request a Batch Upload button on the the SSC - HR - Data Management Batch Upload page, complete the form and attach the spreadsheet.

*Please note: Additional Pay Batchloads are not able to be processed while payroll is running

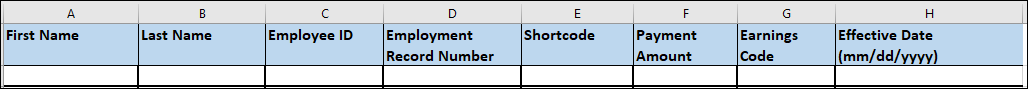

| Letter | Column | Req'd? | Description |

|---|---|---|---|

| A | First Name | Y | The first name of the individual. |

| B | Last Name | Y | The last name of the individual. |

| C | Employee ID | Y | A system-assigned identification number that uniquely identifies an individual in the system. This may also be referred to as the UMID. This number is always eight digits. |

| D | Employment Record Number | Y | Identifies the employment record number on which the additional pay should be paid. |

| E | Shortcode | N | The six-digit number that represents the ChartField combination. To use the funding distribution from the associated Department Budge Earnings (DBE) record, leave this field blank. To override the distribution on the DBE record, populate the field. To split the payment amongst multiple shortcodes, enter a separate spreadsheet line for each shortcode, with prorated payment amounts for each line. |

| F | Payment Amount | Y | The amount of additional pay to be paid within the pay period and charged to the particular shortcode listed on the row. |

| G | Earnings Code | Y | The code used to uniquely identify the type of additional pay (non-base rate pay). |

| H | Effective Date (mm/dd/yyyy) |

Y | Displays the date on which a particular additional row takes effect. Must be the first day of a pay period. |