Overview

The Field Descriptions in this document only cover fields that are applicable to timekeepers.

Navigation

NavBar > Navigator > Payroll for North America > Payroll Processing USA > Produce Payroll > Review Paycheck

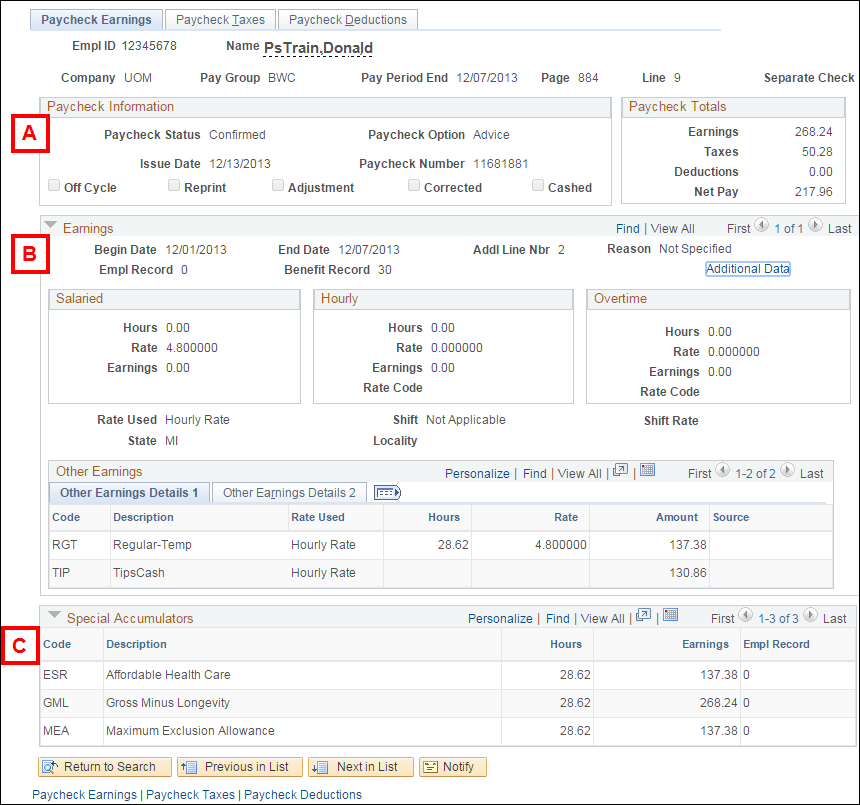

Paycheck Earnings Page

| Letter | Field/Button | Description |

|---|---|---|

| A | Paycheck Information Section | Displays general information about a person's paycheck earnings. This section appears once at the top of each Paycheck Earnings page. |

| B | Earnings Section | Displays detailed information about a person's paycheck earnings. Different types of earnings are displayed in separate Earnings sections, each of which includes an Other Earnings box. |

| C | Special Accumulators | This drop-down list displays data used by the central payroll offices for payroll processing. Timekeepers should ignore this list. |

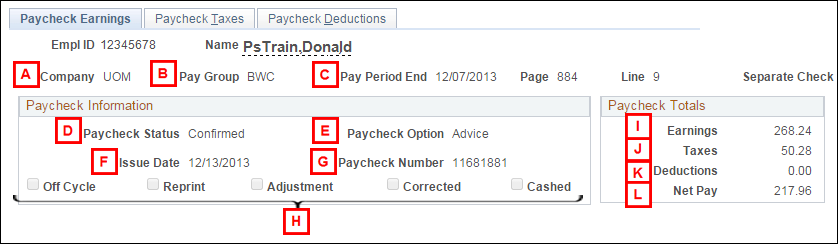

Paycheck Earnings Page – Paycheck Information Section

The section at the top of each Paycheck Earnings page displays general information about a person's paycheck earnings.

| Letter | Field/Button | Description |

|---|---|---|

| A | Company | For payments made to employees, displays UOM. For student refund and award payments issued by the Financial Aid Office, displays STR. |

| B | Pay Group | Identifies the person's pay group. Most biweekly employees are in the BWC pay group. Most monthly employees are in either the MPP or MOR pay group. |

| C | Pay Period End | Displays the last day of the pay period for this paycheck. |

| D | Paycheck Status | Indicates the current status of the paycheck. Once the paycheck is ready for payment, displays Confirmed. |

| E | Paycheck Option | If the payment is made via paycheck, displays Check. If the payment is made via direct deposit, displays Advice. |

| F | Issue Date | Identifies the date on which the payment was issued to the person (commonly referred to as the pay date). |

| G | Paycheck Number | Displays a system-assigned number used by central payroll offices use to track each paycheck or direct deposit advice. |

| H | Special Payment Checkboxes | If applicable, these checkboxes describe the type of special payroll or paycheck for the payment. For regular paychecks, these checkboxes are turned off. |

| I | Earnings | Displays the total gross amount of the payment. |

| J | Taxes | Displays the total taxes taken from the gross earnings. |

| K | Deductions | Displays the total deductions taken from the gross earnings. |

| L | Net Pay | Displays the total net amount of the payment. |

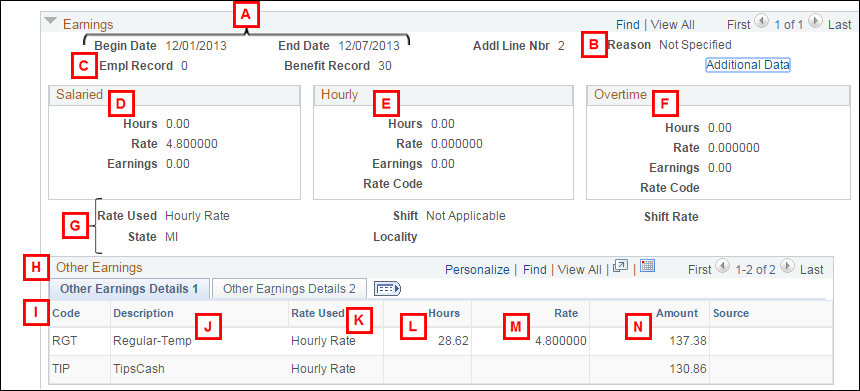

Paycheck Earnings Page – Earnings Section

Different types of earnings and/or date ranges are displayed in separate Earnings sections.

Each Earnings section displays a date range and some general information at the top of the section. The Other Earnings box at the bottom of each section typically displays detailed Earnings Codes, quantities, compensation rates, and amounts.

| Letter | Field/Button | Description |

|---|---|---|

| A | Begin-End Dates | Displays the range of dates the earnings were reported for. This may be the regular pay period or a prior period date/range of dates. |

| B | Reason | Indicates the reason for the earnings (e.g., Benefits Administration Credit). Earnings reported by a timekeeper display a value of Not Specified. |

| C | Empl Rcd# | Displays the Employee Record Number (Empl Rcd#) that the earnings are for. This may differ from one Earnings section to the next because one paycheck may include earnings for more than one appointment. |

| D | Salaried group box | Displays the hourly rate in which REG (regular) hours are paid. |

| E | Hourly group box | Displays the hours, rate and earnings reduced from REG earnings (i.e. holiday, vacation, sick) |

| F | Overtime group box | This group box is not used. |

| G | Rate Used/ State/Locality | Reflects the rate used and state and locality, if city taxes are required, for which taxes are deducted from earnings. |

| H | Other Earnings box | If applicable, this box displays values for other earnings included in the paycheck. Some examples of other earnings are Additional Pay, Benefits Administration Credit, and exceptions/additions to regular earnings (e.g., shift premiums, leave usage, overtime). Refer to the date range at the top of the Earnings section to identify prior period adjustments. Note: Regular earnings display in this box for positive pay employees. |

| I | Code | Displays the Earnings Code for a row of earnings data. |

| J | Description | Displays the short description for the Earnings Code. |

| K | Rate Used | Displays the type of compensation rate used to calculate the earnings amount. In some instances, this rate is not multiplied by the hours to calculate the earnings amount for a row. Instead, it may be a preliminary rate used by the system to calculate the actual hourly overtime rate. For example, when the FLSA rate is used to calculate overtime pay (OTP Earn Code), this rate is not multiplied by the hours to calculate the earnings amount for the straight time portion of the overtime. |

| L | Hours | Displays the hours for a row of earnings data. |

| M | Rate | Displays the compensation rate used for the earnings (i.e. Hourly Rate or FLSA Rate) |

| N | Amount | Displays the earnings amount for a row of earnings data. |